What does debit memo mean on a bank statement?

A debit memo pertaining to banks, called a debit memo bank statement, informs a depositor that the bank will be decreasing that particular account from something other than a debit or check payment. In certain circumstances, a debit memo is typical in the banking business. When a bank charges fees, for instance, a bank can send a debit memo to a specific bank account. Credit memorandum and debit memos can be used to change a customer’s account balance. A customer’s debt increases with a debit memo, while a credit memo reduces credit balance. To apply for this discount, the buyer will issue the seller a debit memorandum.

Provisional Credit: What it is & How it Works Chase – Chase News & Stories

Provisional Credit: What it is & How it Works Chase.

Posted: Mon, 26 Sep 2022 19:49:50 GMT [source]

Debit memos are necessary for a transparent banking system and help you know what you are charged for. So, from now on, the next time a debit memo comes your way, you will find it familiar. Debit memorandums are also used in double-entry accounting to indicate an adjustment that increases a customer’s amount due. Debit memos can also be used in invoicing, such as when debt that was previously written off is recovered. Since the term debit memo contains the word “debit”, which refers to the amount on a ledger’s left side, it is simple to recall what it signifies (when there is no other meaning to the Debit). My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

What is a Debit Memo?

Debit memos can arise as a result of bank service charges, bounced check fees, or charges for printing more checks. The memos are typically sent out to bank customers along with their monthly bank statements and the debit memorandum is noted by a negative sign next to the charge. The bank’s use of the term debit memo is logical because the company’s bank account is a liability in the bank’s general ledger. The bank’s liability is reduced when the bank charges the company’s account for a bank fee. Hence, the credit balance in the bank’s liability account is reduced by a debit.

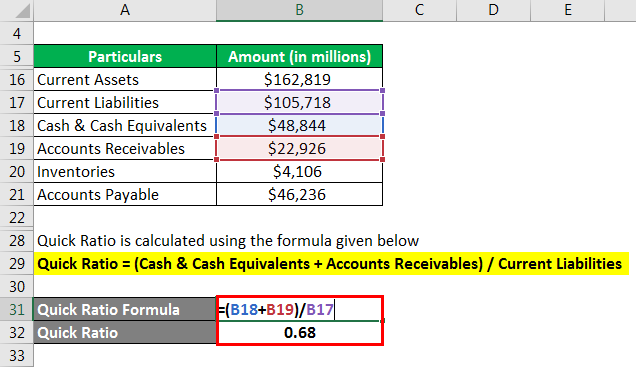

A bank creates a debit memo when it charges a company a fee on its bank statement, thereby reducing the balance in the company’s checking account. Thus, if a bank account has a balance of $1,000 and the bank charges a service fee of $50 with a debit memo, the account then has a remaining balance of $950. Of the usages noted here, bank transactions represent the most common usage of debit memos. A debit memorandum, or “debit memo,” is a document that records and notifies a customer of debit adjustments made to their individual bank account. The adjustments made to the account reduce the funds in the account but are made for specific purposes and used only for adjustments outside of any normal debits. The reasons a debit memorandum would be issued relate to bank fees, undercharged invoices, or rectifying accidental positive balances in an account.

What Is a Debit Memorandum?

In banking, fees are automatically taken out of an account and the debit memorandum is noted on its bank statement. A debit memo or debit note is a notice that clients receive when their account balance has decreased and needs to be rectified. There are several uses of the term debit memo, which involve incremental billings, internal offsets, and bank transactions. When a customer pays too much, the extra can be offset with a debit memo. This allows the accounting department to clear it out by sending the memo back to the customer. If the extra amount in a customer’s account is the result of an accounting error that results in a residual balance, it can also be rectified with a debit memo.

In banking, fees are deducted from an account automatically, and the debit memo is recorded on the account’s bank statement. An entry that informs clients of a modification or adjustment to their account that meaning of debit memo lowers the balance is referred to in accounting as a debit memorandum. Debit notes are separate from invoices because they are generally formatted as letters, and they may not require immediate payment.

Bank statement debit memos

This is true when the debit note is used to inform the buyer of upcoming debt obligations based on amounts that have yet to be officially invoiced. A memo debit could be a pending outgoing electronic payment, a debit card transaction, a fee to issue new checks, an interest payment on a loan, or a not sufficient funds fee. Cindy works for Fluffy Stuffs Inc., a toy company specializing in the manufacture of stuffed animals. The company has recently sold a large shipment of stuffed animals to Toys N’ More.

Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. You must — there are over 200,000 words in our free online dictionary, but you are looking for one that’s only in the Merriam-Webster Unabridged Dictionary. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.